A Tale of Two Economies

by Florencia Schade

In today’s world of media consolidation and corporate monopoly, propaganda plays a vital role in maintaining the economic status quo. Similar to the “Bidenomics” phenomenon in the US, the Canadian state is attempting to browbeat workers into believing that “the economy is good, actually”. This claim is propped up by problematic metrics designed to uphold a neoclassical economic model that safeguards the elites by cooling class antagonism.

While the problem of economic statistics is widespread and rampant throughout current modelling, chiefly misleading among these is the metric of aggregate GDP. Cherry picked data points are meant to create the illusion that the ‘economy is booming’ without critically answering the question: for who? As heterodox economists such as Michael Hudson and Clara Mattei point out, the central flaw of this model is the assumption of a naturalized ‘market equilibrium’ which sidesteps the real machinations of political economy (including the use of debt and interest) that drives the distribution and allocation of real resources along class lines.

It’s true that Canada’s aggregate GDP has been leading the G7 since 2021, however this is directly buoyed by the Liberal’s historic immigration push which now plans to bring in 500,000 people per year by 2025. This “plan” or lack thereof, was specifically meant to address the “labour shortage” but nothing else, leaving newcomers to join the masses of workers being churned into affordability, housing, and healthcare crises; so much so that permanent residency applications have started to decline in favour of more short-term visas. The simple fact that more people in the country results in more aggregate transactions does not mean that the economy is healthy because a) GDP includes many unproductive gains such as service fees and b) it doesn’t account for distribution.

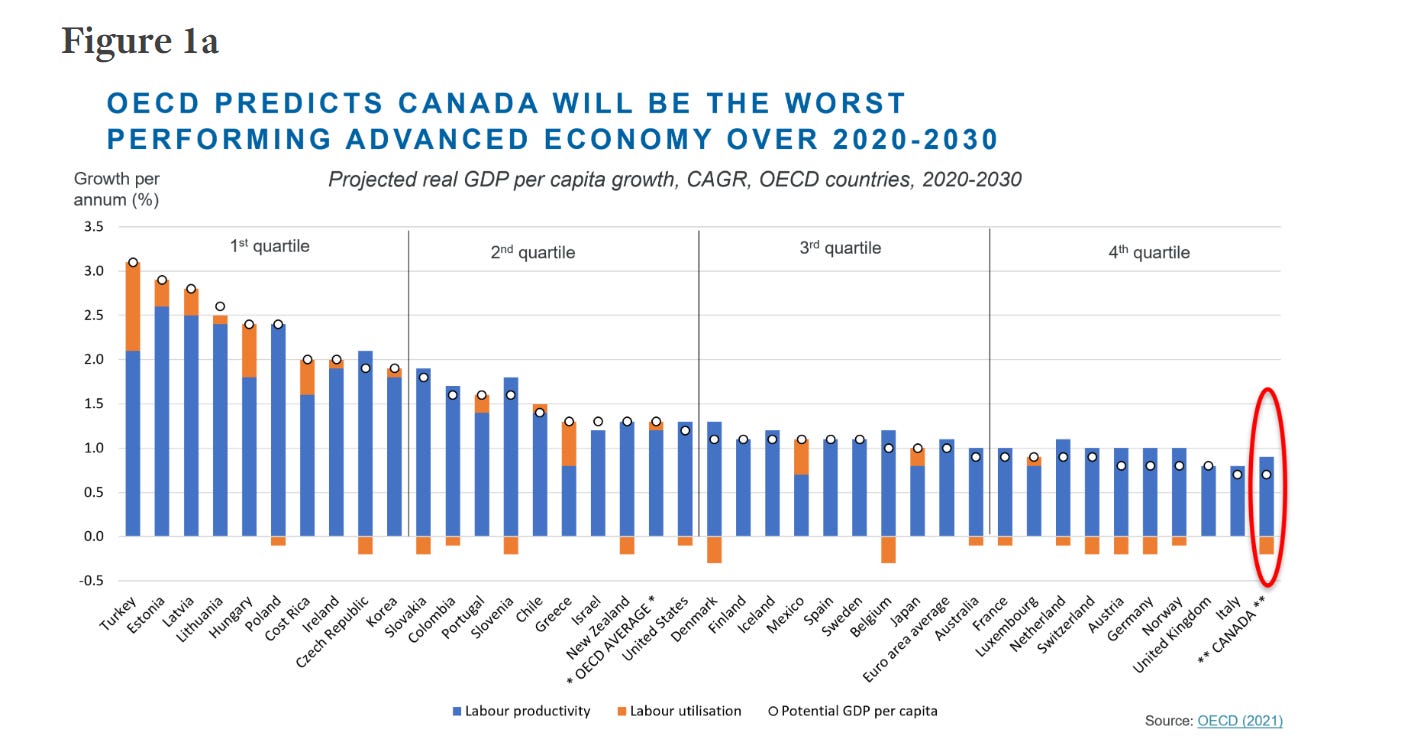

A more relevant metric is per capita GDP growth, often referred to as a basic measure for standard of living, which has been on the decline. While the trend predates the pandemic, StatCan shows that “since 2020, Canada’s GDP per capita growth has averaged a decrease of 1.3% per year.” A 2021 OECD report put Canada on track to perform worst on this metric (tied with Italy) out of all OECD countries by 2030 and to maintain last position into 2060.

A Business Council of BC analysis concludes: “If the OECD’s long-range projections prove correct, young people entering the workforce today will not feel much of a tailwind at all. Rather, they face a long period of stagnating average real incomes that will last most of their working lives. On average, Canadian living standards and our quality of life relative to other countries are set to decline as other countries make their economies more productive.”

The 2023 OECD Survey on Canada’s economy highlights “considerable uncertainty” as “high household debt levels could cause private consumption to contract, particularly if job creation slows”, and typically assumes that if this doesn’t happen it will be because productivity gains will somehow ‘trickle down’ as “high levels of immigration should, in the near term, slow population ageing and could push GDP growth….[and] newcomers skills and higher workforce capacity might further expand the economy’s productive capacity.”

It’s magical thinking to believe that new capital will result in widely developed productive capacity when dropped into a financialized, parasitical economy that prioritizes asset inflation, stock buybacks, mergers, and dividends over real investment every time. The contradictions facing Capitalism are laid bare throughout the OECD reports as the need for an ever-growing consumer base struggles to be reconciled with monetary tightening that is attempting to throttle the very demand that keeps a credit-driven consumer economy afloat. Status-quo defenders attempt to gloss over this impasse by focusing on largely irrelevant, deceptive statistics, but working people on the ground know better as we live out the material truth of deteriorating conditions.

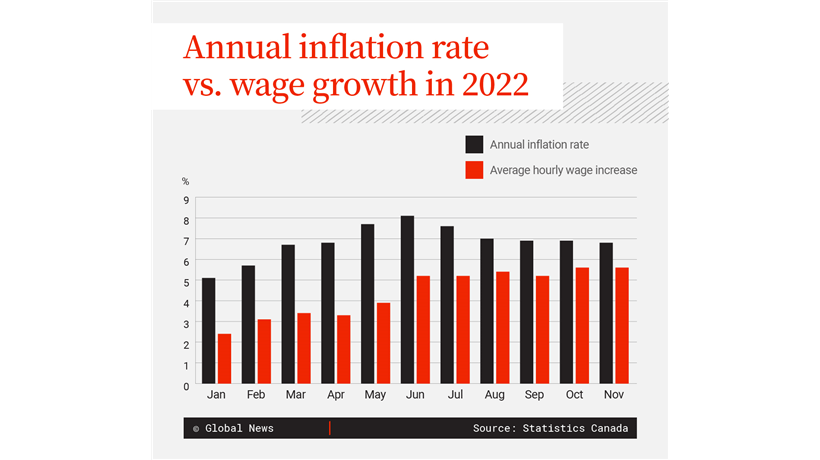

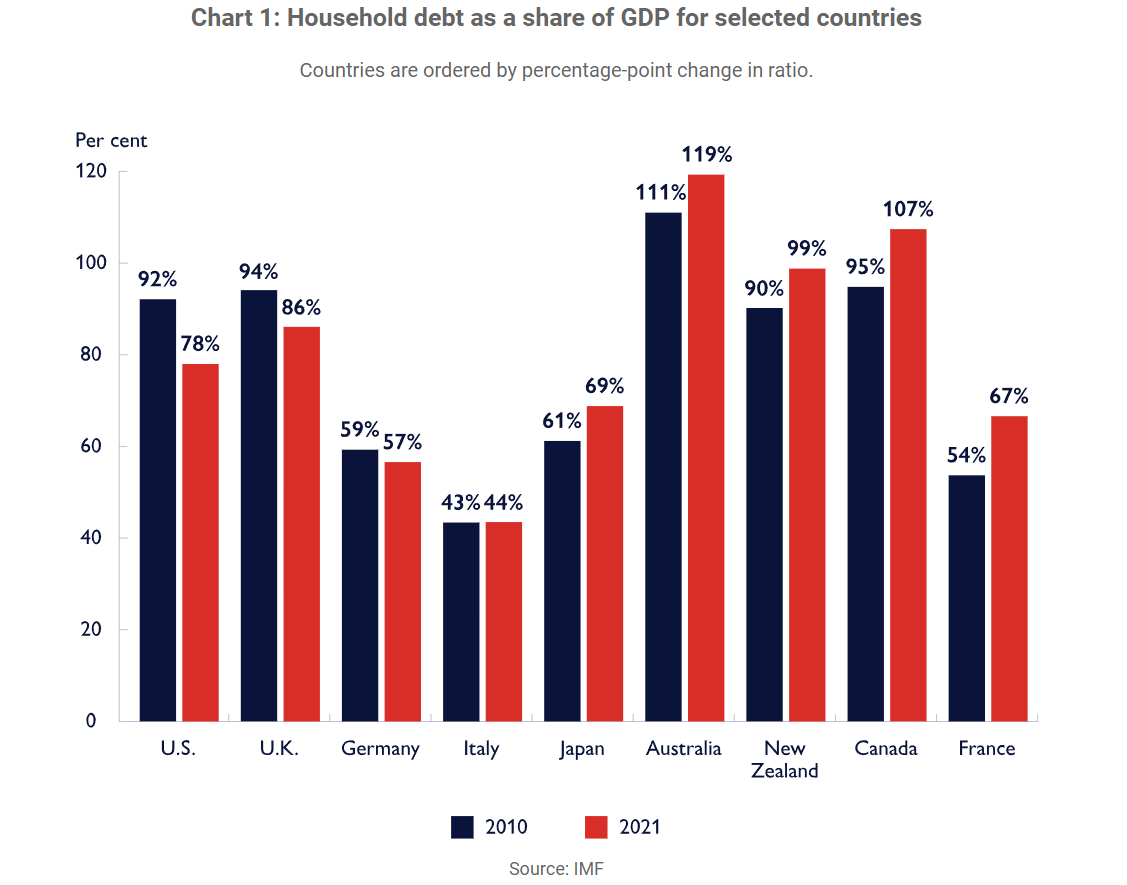

No issue crystallizes the absurdity of the neoliberal subset of neoclassical economics more than the housing crisis. Increased privatization and speculative repackaging of basic needs such as food and shelter has meant that cost of living is determined by corporate monopolies who at the same time suppress wage growth. Lagging wage growth and a stagnating standard of living has predictably resulted in steeply increased debt burdens for Canadian households.

Not only are we projected last in per capita GDP growth but Canada leads the pack as having the most indebted, overleveraged households in the G7, a mild change from 2017. Correspondingly, the IMF reports that Canadian mortgages carry the highest default risk in the OECD due to high debt, sluggish wages, and rising cost of living.

The true homeowners of our society, the big banks, have kept housing from becoming an immediate wrecking ball to the economy by refinancing mortgages with lifelong terms for repayment. In a stunning change over a single year, 2022-23, four out of five of Canada’s big banks jumped from portfolios with only 1-2% of mortgages with at least 35 years of repayment to a 25-30% share with 35 plus years left in what boils down to a huge number of “homeowners” entering modern day debt peonage via amortization. Still, delinquencies and defaults on other loan types such as installment, auto, and credit card loans are on the rise into 2023. Consumer insolvencies rose a startling 15% between January 2022-23 indicating that more folks are having to “rob Peter to pay Paul” just to keep a roof over their heads.

StatCan data reveals the first quarter of 2023 ushered in a record breaking surge in the rate of income inequality, the fastest increase since 2010. While pandemic response created a flash in the pan counter trend, income inequality is now back at pre-pandemic levels with no mitigation in sight. Already as of 2020 the top 20% in Canada held over 65.7% of national wealth, while the bottom 40% held just 2.5%.

The wealth gap is coalescing into a generational gap as the consequences of creating an economy dependent on a speculative housing bubble come full circle. Millennials 45 and under are increasingly locked out of the asset-obtaining, equity-leveraging middle class and all the unproductive, economic rent seeking opportunities that came with it.

Neoclassical economics presupposes a monetarist fantasy of market equilibrium, a laissez-faire approach which itself produces scarcity among the working class in order to justify and implement austerity politics; a circular logic that invariably results in fat cats getting fatter while the masses starve. Political economy challenges us to understand who the economy ‘works for’, how, why, and through what structures.

Under Capitalism production is determined only by profiteering. If the political economy is wholly market reliant, then the “anarchy of the market” (to quote Marx) will mindlessly extort every basic need and package it for the stock market until we are paying for air to breathe, and with the climate crisis barreling upon us, that may not be much longer.

One viable solution the Socialist Caucus advocates for is a Federal Jobs Guarantee (as part of a Guaranteed Livable Income Program for those unable to work) to forcibly tilt production back towards the real economy that addresses human needs through a massive public works program, thus countering the austerity by which neoliberal financialization maintains its power over an oppressed underclass. This policy would transform the economy in favour of worker power and subordinate “the market” to meet the public standard, not vice-versa.

Humanity deserves governments that guarantee basic needs as a matter of principle. Socialist political economic planning bridges the gap between the ‘two economies’ by dropping the propaganda and focusing on material conditions, universal basic needs, and the formation of a workers’ government to democratically secure them for all.